Solve finance system challenges

in your business

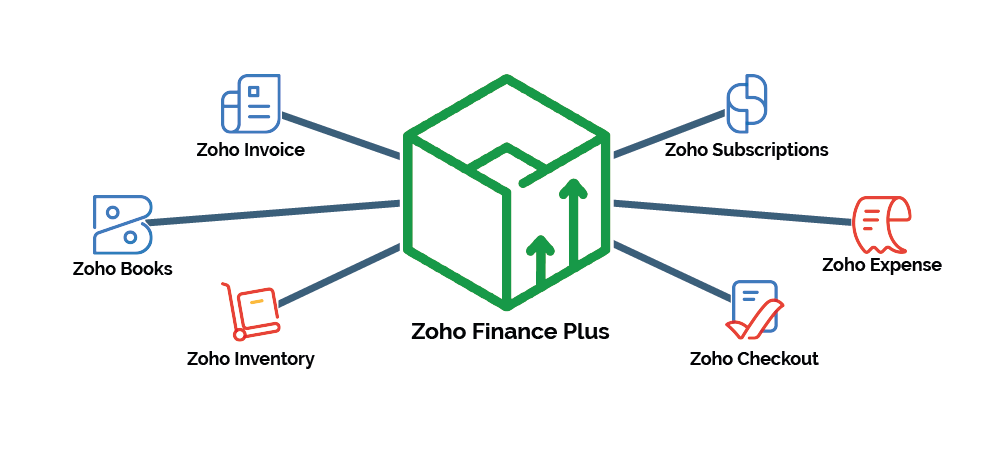

Is your SMB facing finance system challenges that hinder growth and success? Limited resources, inefficient financial management, inconsistent processes and siloed data can pose obstacles. However, you can overcome finance system hurdles, optimise financial processes, and drive profitability through Zoho solutions.

What finance system challenges are you are facing?

As a Digital Transformation consultancy, we have knowledge of the very best technology, data, process and workplace culture practices. Furthermore, as a Zoho Advanced Partner we are positioned perfectly to offer the very best Zoho solutions for your needs. Together this gives us the expertise to overcome many of your finance system challenges.

Let’s look at some finance system challenges we hear about from businesses that want to take their systems to the next level.

Simplify Financial Planning and Budgeting

Difficulties in creating accurate and realistic financial plans and budgets that align with business goals.

With Zoho Finance, you can simplify financial planning and budgeting by leveraging features like automated budget creation, real-time data integration, and scenario modelling. This helps create accurate and realistic financial plans that align with your business goals.

With Zoho Finance, you can streamline financial planning and budgeting processes by integrating finance, sales, and operations data in a centralised platform. This enables collaboration, improves efficiency, and ensures accuracy in your financial planning and budgeting processes.

With Zoho Finance, you can track and monitor your financial performance through clear dashboards and reports. This enables you to compare actual results against budgeted targets, identify variances, and take timely corrective actions to stay on track with your financial goals. To take it even further you can easily integrate Zoho Analytics to open up the world of dynamic, real-time dashboards and reporting.

Zoho’s financial planning and budgeting solutions enable you to consolidate financial data from multiple sources, such as different departments or business units. This facilitates comprehensive financial planning and budgeting by providing a centralised view of your organisation’s finances.

Zoho Books offers robust reporting capabilities that allow you to generate customised financial reports and dashboards. This enables effective analysis and decision-making by providing actionable insights into your organisation’s financial performance.

With Zoho’s financial planning and budgeting solutions, you can create rolling forecasts and perform scenario-based planning. This allows you to adapt to changing market conditions and make informed financial decisions by evaluating different scenarios and their impact on your organisation’s financial performance.

With Zoho’s finance solutions, you can track project profitability by automating reports that break down income and expenditure in real-time. This allows you to gain insights into project performance, identify areas for improvement, and make data-driven decisions to ensure profitability throughout the project’s lifecycle.

Reports generated in Zoho Books>Reporting>Profit and Loss can be taken to a more granular level with “Tags”. In Zoho Books, tags are a way to categorize and label transactions or items. You can assign tags to transactions, contacts, items, or projects to group and track them based on specific criteria. This helps you organise and analyse your financial data more effectively, allowing for better reporting, filtering, and analysis based on the assigned tags.

Yes, Zoho solutions can handle multi-currencies, allowing you to manage financial planning and budgeting across different currencies, streamline currency conversions, and track transactions in various currencies.

You don’t even have to worry about exchange rates. Zoho Books will fetch the exchange rates automatically for the given foreign currency when the transactions are created. These exchange rates are through a third-party service provider, Open Exchange Rates, against the base currency of your organisation.

Financial Reporting

Challenges in generating timely and accurate financial reports, such as balance sheets, income statements, and cash flow statements, to support decision-making.

With Zoho’s financial reporting solutions, you can streamline your SMB’s financial reporting processes by automating data collection, consolidation, and analysis. This ensures accuracy and timeliness in generating financial reports, enabling better decision-making and compliance with reporting requirements.

Zoho’s financial reporting solutions enable SMBs to generate standardised financial reports, such as balance sheets, income statements, and cash flow statements, in a timely manner. By automating data consolidation and report generation, you can have up-to-date information for better decision-making.

As a Zoho partner, we can help you integrate your existing accounting software with other systems to consolidate data from multiple sources. This will provide a unified view for reporting purposes, enabling more comprehensive and accurate financial reporting.

As a UK, Zoho Partner, we can help you implement data validation and data integrity checks in your financial reporting processes. This ensures the reliability and accuracy of your financial information by identifying and resolving any data inconsistencies or errors.

As a Zoho partner, we can help you implement customisable and ad-hoc reporting capabilities in your financial system. This allows you to generate tailored reports on-demand, meeting specific business requirements and providing flexibility in your financial reporting process.

Yes, with Zoho’s financial reporting solutions, we can automate the report generation and distribution process. This allows each department to access and view their own reports, saving time and reducing manual effort in the financial reporting process.

With Zoho’s financial reporting solutions, you can generate a variety of reports with built-in analytics and visualisation capabilities. This allows you to gain valuable insights from your financial data and present it in a meaningful way, whether through spreadsheets, charts, or other visualisations.

Zoho’s finance system reporting provides real-time visibility into your financial position and offers forecasting capabilities, empowering SMBs with accurate insights to support expansion and make informed financial decisions.

Yes, to analyse nominal accounts and build reports showing cash and accrual information in profit and loss reports, you can leverage Zoho Books. By customising your report settings, you can include relevant nominal accounts, enable cash or accrual basis, and generate reports that provide insights into your financial performance based on your preferred accounting method and date ranges.

With Zoho’s financial reporting solutions, you can gain real-time visibility into project performance by tracking actual invoices and expenses. Easily generate Profit and Loss Reports that provide a clear overview of project invoicing and expenditures for better financial analysis and decision-making.

In Zoho, Profit and Loss Reports, “Tags” serve as a way to categorise and classify transactions or expenses. By assigning tags to transactions, you can group related items together based on specific criteria such as project, department, location, or any custom category.

This allows you to analyse and track expenses more granularly, providing deeper insights into cost allocation, profitability by tag, and expense trends across different segments of your business.

Simplifying Expense Management

Issues in tracking and controlling expenses, including expense approvals, reimbursement processes, and expense reporting.

Zoho’s expense management solutions enable you to streamline and automate your expense reporting processes. This helps improve efficiency, reduce manual effort, and provides a seamless experience for employees to submit and track their expenses.

Zoho’s expense management software offers features like mobile expense capture, receipt scanning, and automated expense tracking. These technologies simplify the process of capturing, tracking, and managing expenses incurred by employees and teams.

Yes, Zoho’s expense management solutions can integrate with existing systems such as credit card providers and expense management platforms, allowing for seamless data transfer and reconciliation, simplifying the expense management process.

Zoho’s expense management solutions offer features such as policy enforcement rules, automated approval workflows, and real-time expense tracking to actively enforce expense policy compliance, ensuring expenses are within approved limits and align with company guidelines.

Zoho’s expense management solutions provide the ability to generate expense reports and analyse expense data, allowing SMBs to gain insights into spending patterns, identify areas of excessive expenses, and implement effective cost control measures.

Zoho’s expense management solutions offer mobile expense reporting capabilities, allowing sales teams to capture receipts and submit expense claims in real time. The mobile app ensures secure access and data encryption, providing a convenient and secure solution for on-the-go expense management.

Zoho’s expense management solutions offer approval workflows and notifications, streamlining the approval process for expense claims. This ensures that expense reports are reviewed and approved in a timely manner, reducing rejections and enabling prompt reimbursement.

Improving Accounts Payable and Receivable processes

Difficulties in managing vendor invoices, timely payments, collections, and maintaining good customer relationships.

Zoho’s accounts payable solution enables efficient tracking and management of vendor invoices, payments, and reconciliation. It automates processes, streamlines workflows, and provides real-time visibility, enhancing control and efficiency in accounts payable management.

Zoho offers integrations with various banking platforms and payment gateways, allowing seamless transactions and automated recording of receivables and payables. This integration streamlines processes, enhances accuracy, and improves efficiency in managing accounts payable and receivable.

Zoho provides solutions that automate invoice processing, ensuring accurate and timely generation, delivery, and tracking of invoices. This streamlines the accounts payable and receivable processes, reduces errors, and improves efficiency.

Zoho offers customisable financial reporting features that allow you to generate reports related to accounts payable and receivable, such as aging reports, cash flow projections, and payment performance analysis. This helps you gain insights and make informed financial decisions.

Yes, Zoho provides automation capabilities for invoice approval workflows, allowing for streamlined processes and ensuring timely payments and collections. This helps improve efficiency and reduces manual effort in accounts payable and receivable processes.

Zoho offers solutions to help manage back orders and sales returns by providing features such as inventory tracking, order management, and return management. These capabilities streamline the accounts payable and receivable processes, ensuring accurate records and efficient handling of back orders and returns.

Zoho provides features for managing calling off orders within its accounts payable and receivable processes. With capabilities like purchase order management and invoice tracking, businesses can effectively handle the process of calling off orders and ensure accurate records of transactions.

Zoho offers functionalities to handle credit notes on customer accounts and overpayments on supplier accounts. Businesses can easily record credit notes, apply them to customer accounts, and track overpayments to ensure accurate accounts payable and receivable management.

No, Zoho finance solutions can accommodate customer-specific pricing deals. You can set up custom pricing agreements for individual customers, ensuring accurate invoicing and seamless management of exclusive pricing arrangements. Their unique pricing is pulled into estimates, invoices and remains exclusive for them, while others have their own unique price lists or your default set.

Zoho finance solutions offer comprehensive credit control functionality for both purchasing and selling. You can set credit limits, manage credit terms, track outstanding payments, automate reminders, and reconcile accounts receivable and payable efficiently.

For example, your sales teams will be automatically flagged if their account holder has reached their credit limit based on data in the CRM record. Alternatively if you have reached your credit limit with a supplier you automated workflow will kick in forcing a non-standard procurement process to be followed.

Stock and Inventory Management

How might stock and inventory issues impact your finance systems?

Yes, Zoho offers stock and inventory management solutions that can be seamlessly integrated with your finance package. This allows you to track and manage your stock levels, costs, and sales, enabling you to incorporate stock control into your overall financial management and profit and loss reporting.

Yes, Zoho’s stock and inventory management solutions can cater to both physical and accounting stock control. You can track your physical stock levels based on sales orders and purchases, while also ensuring accurate account based on bills and invoices for reporting of stock-related transactions for profit and loss analysis.

Zoho finance solutions use various valuation methods such as First-In-First-Out (FIFO), Average Cost, and Last-In-First-Out (LIFO) to value stock. These methods help determine the cost of goods sold and the value of remaining stock for accurate profit and loss reporting. At the same time making sure stock costings are relevant and Zoho can account for landed costs.

Zoho’s Stock and Inventory Management solutions can efficiently handle warehousing across multiple sites, allowing SMBs to effectively manage and track inventory in different locations, streamlining operations and ensuring accurate stock control.

Migration from another system

What are your concerns regarding moving from your existing solution and what benefits will be seen from the process?

Zoho’s finance system offers great integration capabilities, allowing us to map and align your existing data and processes. We will work closely with you to ensure a smooth integration and maximise the efficiency of your finance operations.

At the outset of a project we will complete a Discovery workshop with you to understand how your business works and ensure all systems work together. Here we understand how you’d like to set rules and preferences to get your solution right for day one.

The timeline and process for migrating your financial data to Zoho will depend on the complexity and volume of data. Our team will work closely with you to develop a tailored migration plan, ensuring a smooth and efficient transition within the agreed timeframe.

Goldstar follows a rigorous data migration process, ensuring data accuracy and integrity by performing thorough validations, data mapping, and testing. Our experienced team will guide you through the migration to ensure a seamless transition with minimal disruption to your data.

We will work with you to bring your new solutions online on a particular date that is know by all stakeholders. Prior to that day we will have tested the systems integrity rigorously with Trial balances to ensure a smooth changeover. On that day we will bring over all open balances and make the switch when we know everything is correct. WE look to ensure there is no need to run parallel systems for any transition.

Zoho offers a wide range of features and functionality to cater to various business needs. Our team will work closely with you to understand your requirements and ensure that Zoho solutions will support the specific features you need in your finance system migration.

We provide comprehensive support and training resources to ensure a successful transition to Zoho. Our team will assist you with onboarding, data migration, and ongoing training to empower your team in using the finance system effectively.

During the migration to Zoho, it’s important to consider data compatibility, user training, and any customisations required. Goldstar’s team of experts will guide you through the process and ensure a smooth transition, minimising any potential challenges.

The migration to Zoho will enhance your financial operations and reporting capabilities by providing a robust and integrated system. You’ll experience improved efficiency, streamlined processes, and access to advanced reporting features, empowering better financial decision-making.

Yes, Goldstar will work closely with you in the run up to your transition to ensure everything runs smoothly. We provide migration assistance to help map and align data structures from your current system. This ensures a smooth transition, allowing you to efficiently transfer your data to Zoho’s finance system.

Zoho’s finance systems offer reliable, secure, and scalable solutions. With a track record of robust performance, industry-leading security measures, and the ability to scale as your business grows, Zoho stands out as a trustworthy and dependable choice for SMB owners migrating from other solutions.

VAT Compliance and MTD

Challenges in staying compliant with UK tax regulations, managing tax calculations, and submitting accurate and timely tax filings.

Zoho offers tax compliance solutions that help SMBs ensure compliance with UK tax regulations, including VAT reporting, payroll taxes, and other tax obligations. These solutions streamline tax processes, provide accurate reporting, and help meet all tax compliance requirements.

Zoho provides tax compliance solutions that automate the calculation and recording of tax liabilities, ensuring accuracy. These solutions generate the necessary reports for tax filing purposes, making tax compliance easier and more efficient for SMBs.

Zoho’s tax compliance solutions can integrate with HMRC systems and other tax-related platforms, enabling streamlined submission of tax returns and automation of tax-related processes for SMBs.

Zoho’s tax compliance solutions are regularly updated to align with changing UK tax regulations, ensuring that SMBs stay up-to-date with the latest requirements and maintain compliance with tax laws.

Zoho’s finance systems offer robust reporting features, including comprehensive tax reports, summaries, and analysis, enabling SMBs to maintain accurate records, meet tax obligations, and gain valuable insights for effective tax management.

Zoho’s finance systems provide tax planning and forecasting capabilities, empowering SMBs to make informed financial decisions, optimise their tax position, and proactively manage their tax obligations for greater financial efficiency.

Zoho’s finance systems include built-in compliance checks and validations, ensuring the accuracy and integrity of financial data, reducing the risk of errors or penalties, and facilitating UK tax compliance for SMBs.

How we’ve helped other businesses

How can you solve finance system challenges

with Zoho solutions?

Who we work with

What other challenges does your business currently face?

We know business challenges are not limited to one area, take a look at some of the solutions we can offer in other parts of your business.