Zoho Inventory update January 2024

Welcome to our Zoho Inventory update January 2024 blog! As Zoho Advanced Partners, we’re excited to bring you the latest enhancements that cater to the unique needs of SMB owners and Zoho experts. In this edition, we’ll dive into the valuable updates designed to elevate your inventory management experience.

Unleash efficiency with the new Customer and Vendor Number feature!

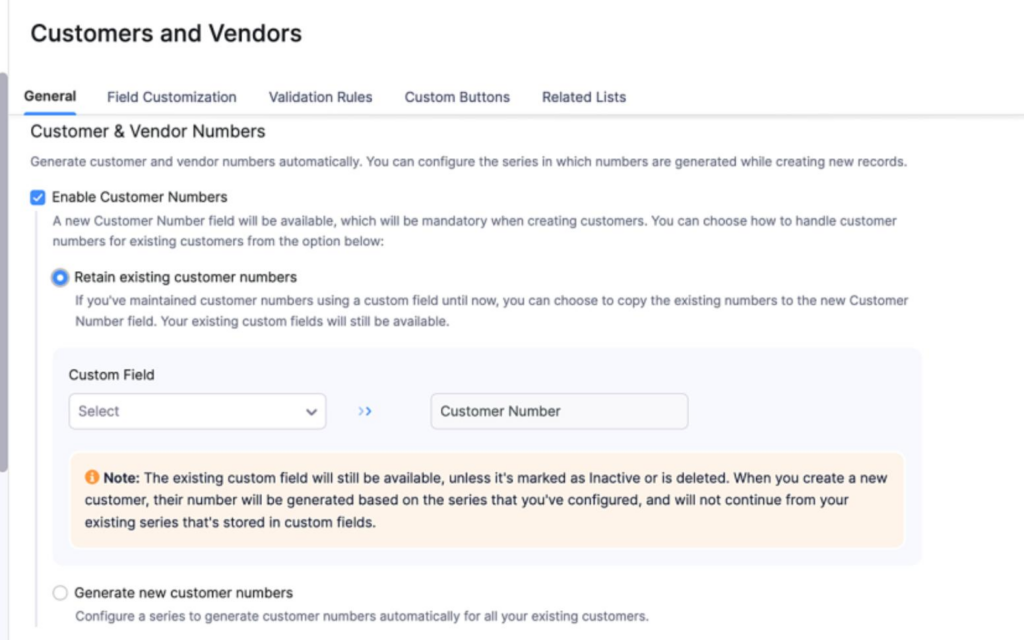

Enhance your customer and vendor management with unique identification numbers, preventing duplication for a more organised database. Simply configure this option in Customers & Vendors Preferences from Settings.

For new contacts, easily input the number in the Customer Number field or automate it through the auto-generate feature. Managing existing contacts is equally seamless—retain existing numbers through custom fields or generate new ones effortlessly. Streamlining your customer and vendor data has never been more efficient, ensuring a smoother workflow for your business.

Business benefits of new Customer and Vendor numbers

Enhance organisation by preventing duplications and ensuring a streamlined database. This update simplifies data management, allowing for easy identification of contacts. Whether it’s new customers or existing ones, the unique identification numbers bring clarity to your business records, optimising your workflow for enhanced productivity.

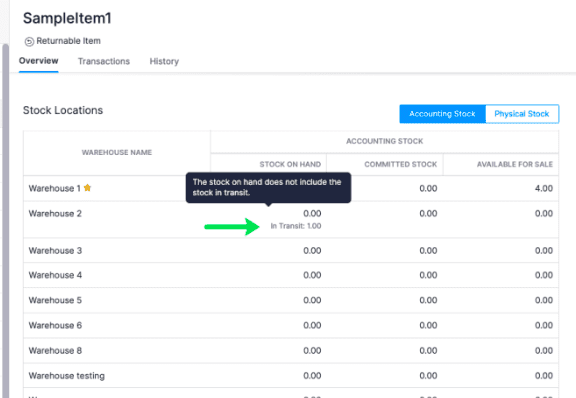

Empower inventory management with the new “In Transit Stock in Item” details view!

With a simple click, swiftly access the Transfer Orders list page, streamlining your monitoring process. Experience heightened control and efficiency, making informed decisions for your business’s inventory needs.

Business benefits of new “In Transit Stock in Item” details view

Gain real-time visibility into in-transit stock directly from the item details page. This enhancement ensures accurate tracking of stocks in transit to destination warehouses, providing a comprehensive overview.

This feature allows you to efficiently monitor in-transit stock, providing real-time insights into stock movements. This transparency ensures accurate tracking and streamlines your inventory management. Businesses can now make informed decisions about stock levels and transfers, optimising operational efficiency and minimising delays.

Introducing the CIS Payment and Deduction Statement

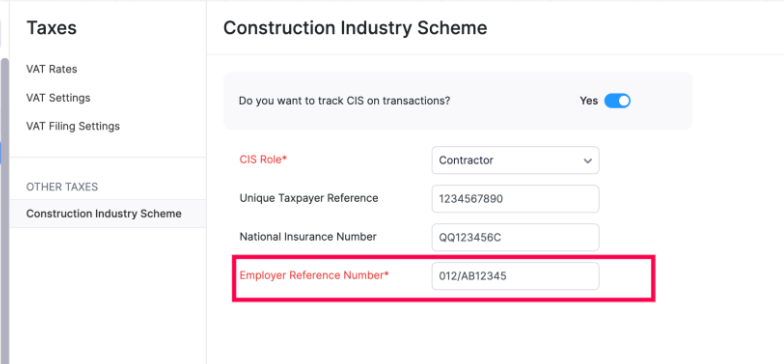

Zoho Inventory now offers support for the CIS Payment and Deduction statement, a crucial addition for organisations utilising the Construction Industry Scheme. This feature simplifies the process of managing payments and deductions, ensuring compliance with CIS regulations. Contractors can easily generate detailed statements, providing a clear breakdown of deductions and payments made to subcontractors. With the introduction of this update, businesses can enhance accuracy, streamline financial processes, and maintain compliance seamlessly within Zoho Inventory.

Here’s what will change in the app once you enable this preference.

Taxes Under Settings: A new field Employer Reference Number (ERN) (For example, 012/AB12345) will be displayed.

Vendor Creation Page: Enable CIS tracking for this Sub-Contractor checkbox. Once this is checked, a new field Verification number (For example, V1234567890) will be displayed, which is required if the deduction rate of the respective subcontractor is high.

Vendor Statement Page: If the selected vendor is CIS Registered, the CIS statement will be displayed under the View option in the Statement tab.

Business benefits of the new CIS Payment and Deduction statement

Enabling the CIS Payment and Deduction statement feature in Zoho Inventory provides businesses in the construction industry with several key benefits. Firstly, it ensures compliance with CIS regulations, preventing any issues related to tax deductions. The simplified process of generating and managing CIS statements within the system enhances accuracy and reduces the likelihood of errors. This streamlined functionality not only saves time but also provides a transparent and organised view of payment deductions made to subcontractors. Ultimately, businesses can maintain regulatory compliance effortlessly, promote financial transparency, and streamline their financial operations.

To enable this feature: Go to Settings > Taxes > Construction Industry Scheme.

We hope you find this Zoho Inventory update January 2024, not only insightful but also integral to optimising your inventory operations. As Zoho Advanced Partners, our commitment is to ensure that your experience with Zoho Inventory remains at the forefront of efficiency and innovation. Stay tuned for more transformative updates, empowering your business journey with Zoho.