Tax Management and VAT Compliance with Zoho Books

Navigating the complexities of tax management and VAT compliance can be challenging for any business. Zoho Books simplifies this process by providing powerful tools to automate tax calculations, generate accurate reports, and ensure compliance with local regulations.

With Zoho Books, you can handle your tax obligations with confidence, saving time and reducing the risk of errors.

Key features of Tax Management and VAT Compliance in Zoho Books

Zoho Books offers a comprehensive set of tools to automate tax calculations, manage VAT compliance, and simplify complex tax scenarios. These features ensure your business stays compliant and your tax processes run smoothly.

Automated Tax Calculations

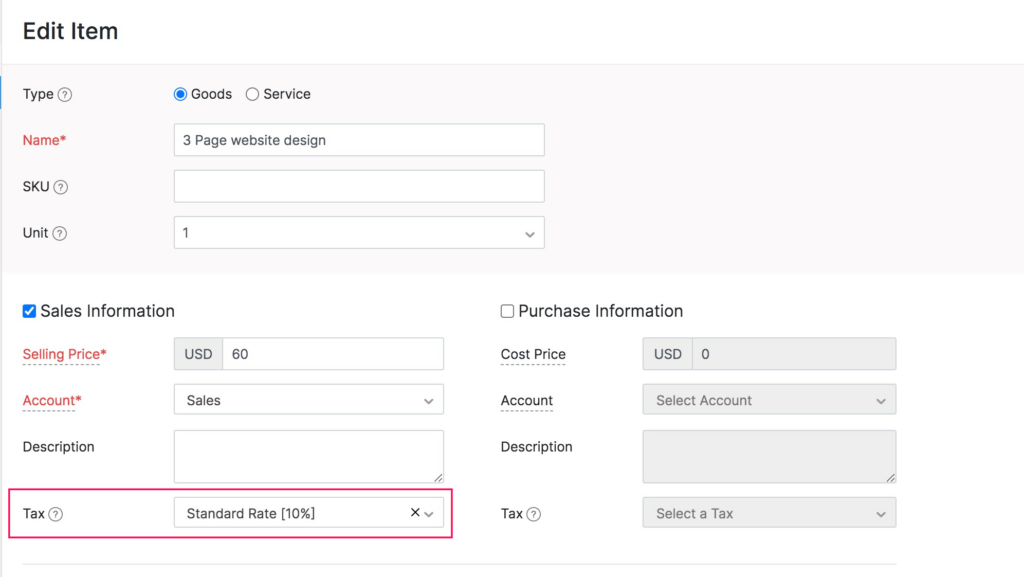

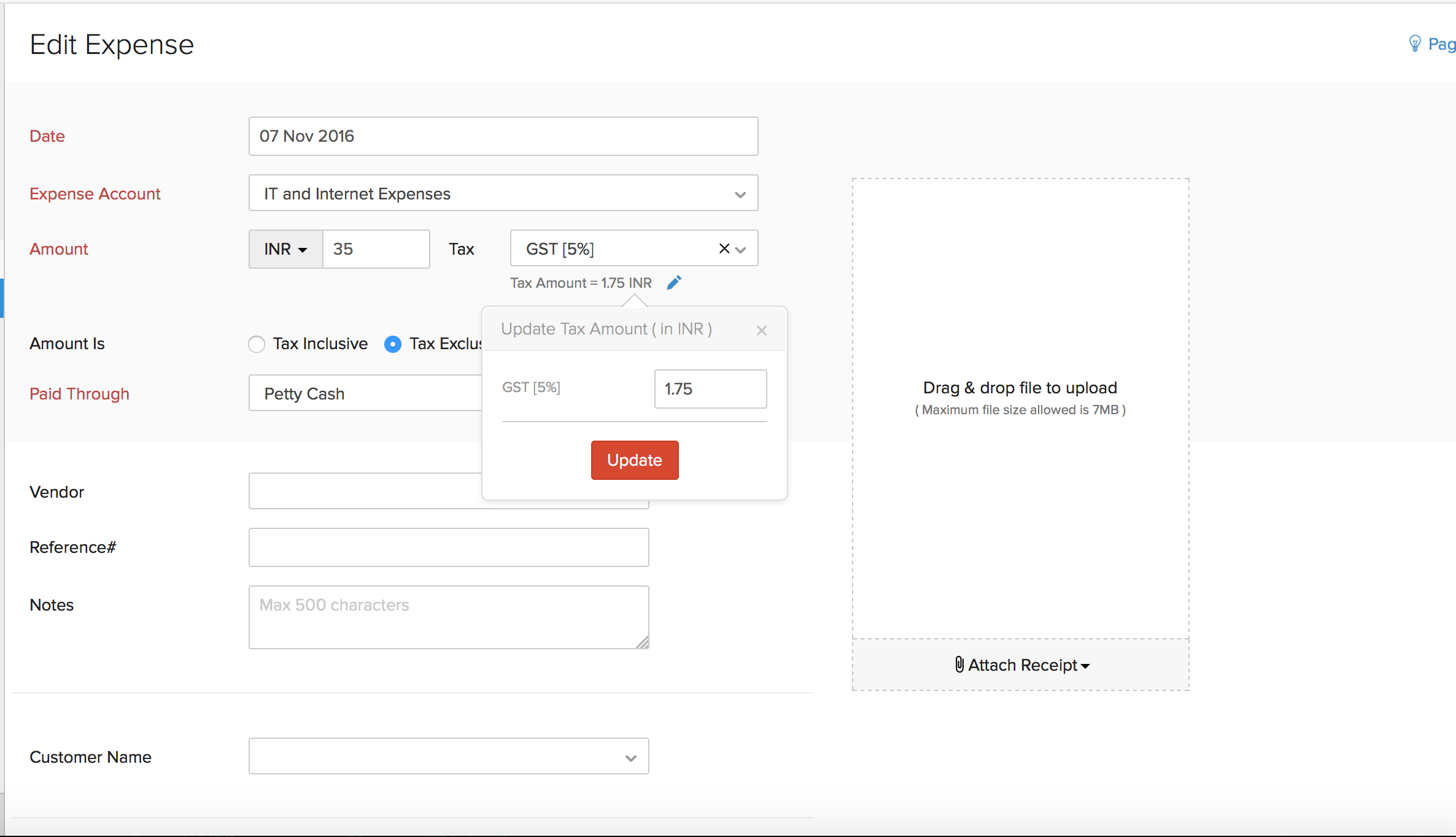

Zoho Books automatically calculates taxes on your transactions based on your location and applicable tax rates. Whether it’s VAT, GST, or sales tax, Zoho Books ensures accuracy and compliance, minimising manual effort and errors.

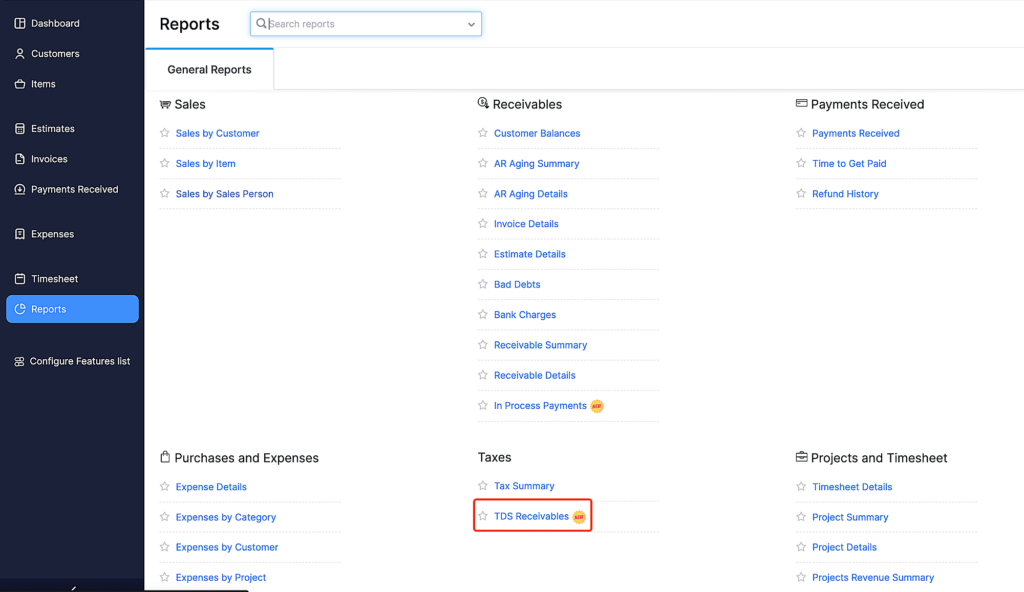

Comprehensive Tax Reports

Generate detailed tax reports, including tax summary, tax liability, and input/output tax reports, with just a few clicks. These reports provide clear insights into your tax obligations and make filing easier and more accurate.

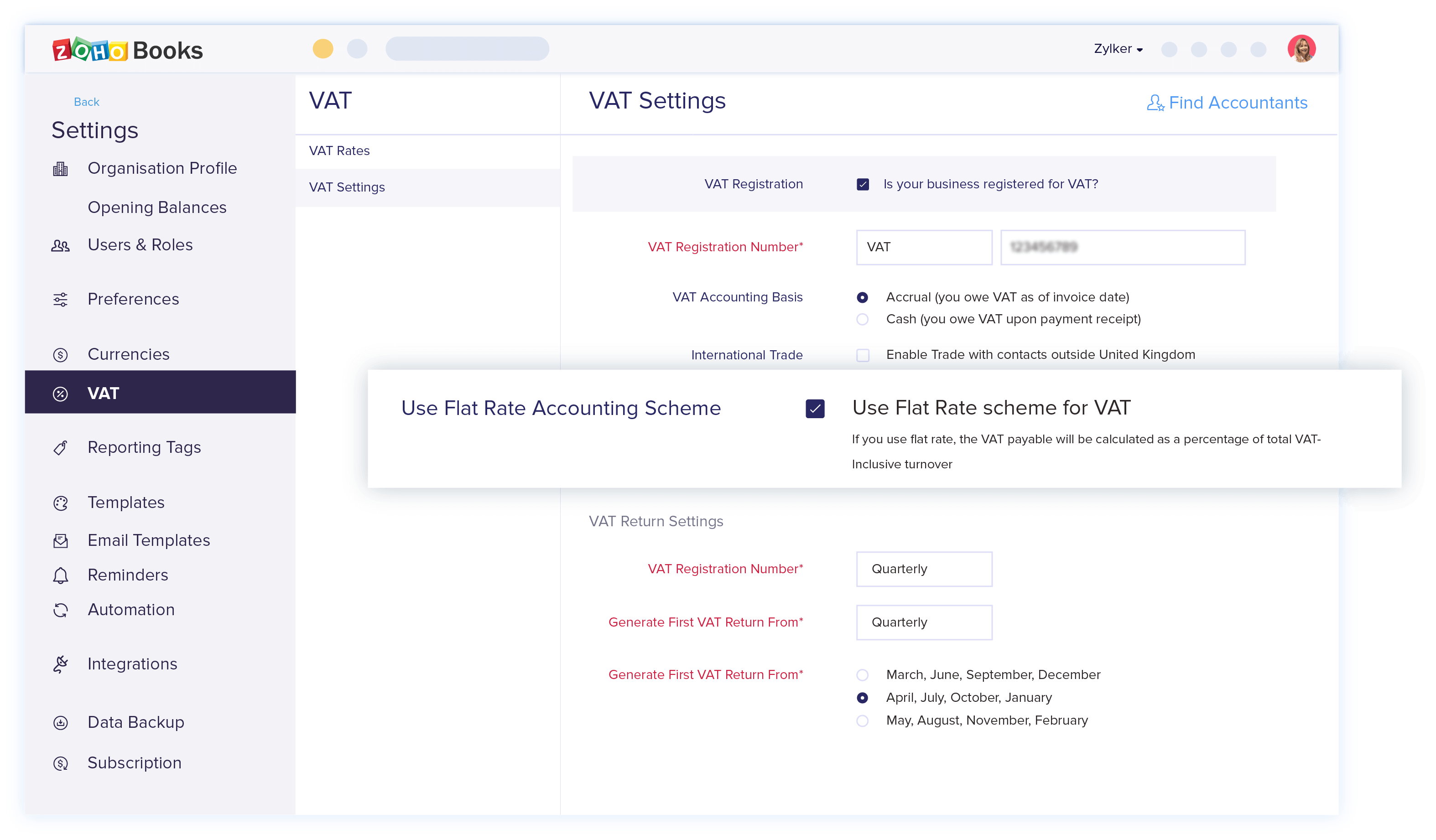

VAT and GST Compliance

Stay compliant with local VAT and GST regulations by applying the correct tax rates and rules to your invoices and expenses. Zoho Books helps you track and manage your VAT or GST returns effortlessly, reducing the stress of compliance.

Multi-Tax Support

Manage multiple tax rates and rules for different regions and products. Zoho Books allows you to apply the appropriate tax settings based on your business’s needs, ensuring accurate tax calculations for every transaction.

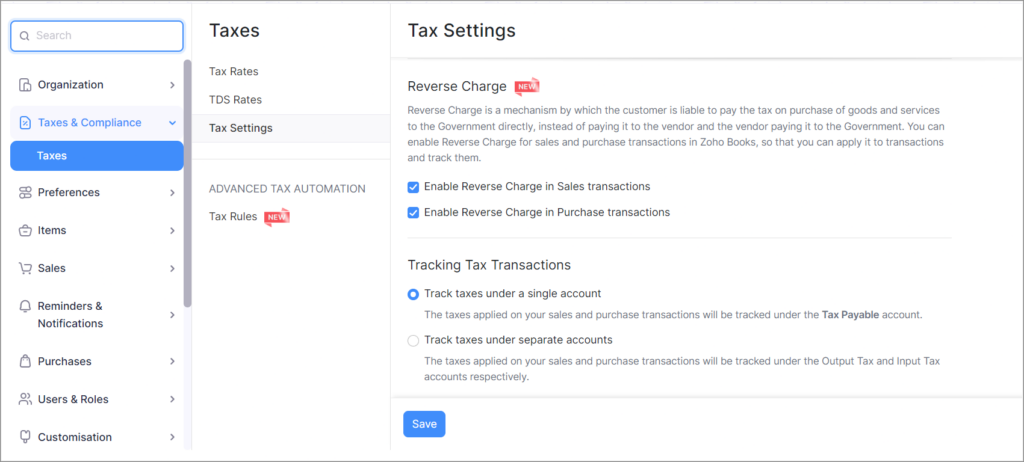

Reverse Charge and Tax Adjustments

Handle complex tax scenarios like reverse charge mechanisms and make tax adjustments when needed. Zoho Books provides the flexibility to manage unique tax situations, keeping your financial records accurate and compliant.

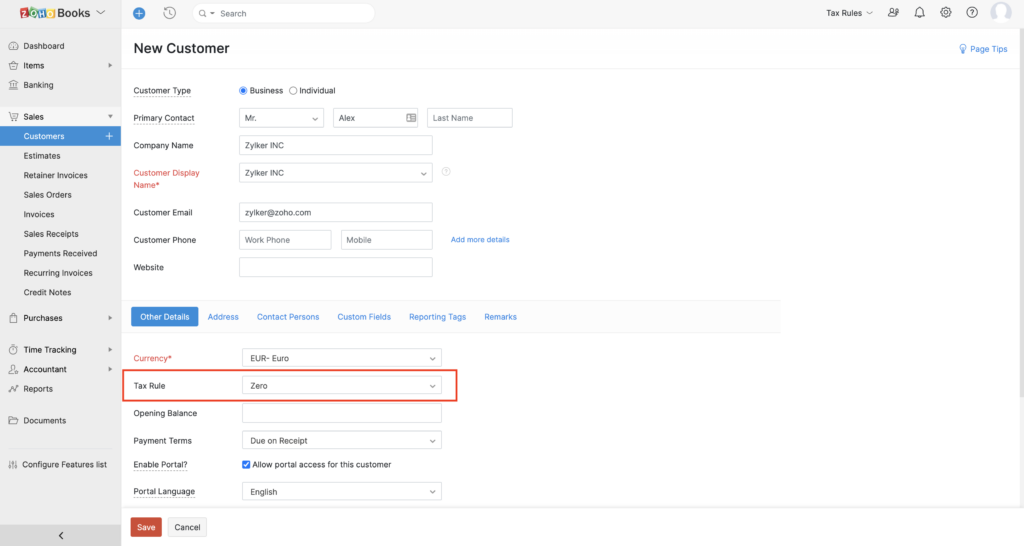

Tax Exemptions and Overrides

Easily manage tax exemptions for specific customers or products, and override default tax rates when necessary. Zoho Books gives you full control over your tax settings to accommodate special cases.

Why choose Zoho Books Tax Management and VAT Compliance?

Zoho Books offers a robust solution for managing your tax obligations, providing automation and accuracy in handling complex tax scenarios.

As a Zoho Partner, Goldstar provides tailored support to help you set up and optimize your tax management in Zoho Books, ensuring compliance and efficiency. With Goldstar’s expertise, you can confidently manage your taxes and focus on growing your business.

How can Zoho Books make a real difference to your business?

When GiftTrees sought to integrate their accounting with their CRM, they turned to Goldstar IT for a seamless migration from Xero to Zoho Books.

Check out our GiftTrees Success Story and discover how this strategic move streamlined their operations, improved financial insights, and cut costs, positioning GiftTrees for future growth.

x

Benefits of using Zoho Books for Tax Management

Ensure Compliance

Automate tax calculations and stay compliant with local tax regulations, reducing the risk of errors and penalties. Zoho Books keeps your tax records up-to-date and accurate, ensuring you meet your tax obligations effortlessly.

Simplify Filing

Generate detailed tax reports and summaries that make filing your taxes straightforward and stress-free. Zoho Books provides all the information you need in one place, streamlining the tax filing process.

Save Time and Reduce Errors

Automate complex tax calculations and eliminate manual data entry, saving time and reducing the chance of mistakes. Zoho Books ensures that your tax data is accurate and reliable, helping you avoid costly errors.

Handle Complex Tax Scenarios

Zoho Books supports advanced tax scenarios, including reverse charges and multiple tax rates, giving you the flexibility to manage unique tax situations effectively.

Who we work with

Let us become your trusted partner

for Zoho Books success

As a certified Zoho Partner, Goldstar offers more than just consulting services—we provide tailored Zoho Books solutions that are aligned with your specific business goals and financial processes. Our Sussex-based team of experts is dedicated to delivering exceptional results, offering end-to-end support from initial setup to ongoing optimisation. We help you fully integrate Zoho Books into your operations, providing comprehensive resources, personalised training, and continuous assistance to ensure that your financial management is optimized for success.

To discover how world-class accounting software can make a difference to your organisation, get in touch for a free consultation.

Ready to launch your business to the next level?

Ready to transform your customer relationships?

Request a free demo or start your free trial today with Goldstar and discover how Zoho CRM can drive your business success!

Or learn more about the right CRM for your organisation with some of our free resources below.