Guide to Making Tax Digital (MTD) for Business Owners in UK

You will have seen a surge in advertising for HMRC’s Making Tax Digital, or MTD, recently and rightly so – it’s set to bring about major changes to the United Kingdom’s tax system. In this blog, we’re going to go over the basics of MTD, its benefits, how it’s going to shake things up and how Zoho Books can help you become and stay compliant.

What is Making Tax Digital and what does it mean for businesses?

MTD is a government initiative to reform and modernise the UK tax system. Additionally, it hopes to make tax reporting easier for businesses. From April 1, 2022, all VAT registered businesses must keep a digital record that updates automatically and stores all relevant company data in one place. This online system is intended to increase transparency and eliminate errors that might arise with paper tax filing.

As a part of MTD, all businesses will have access to a digital tax account. Using this, they will submit tax information to HMRC on a quarterly basis bringing an end to annual tax filing.

How will Making Tax Digital change how you do things?

Making Tax Digital aims to restructure the entire tax system in the UK. This means businesses will have to follow a set of standard practices and file quarterly reports. For many preparations have already begun, with businesses moving accounting online to increase efficiency and accuracy.

Digital recordkeeping:

Businesses and individuals who file with HMRC must use digital tools instead of paper forms for record keeping. Failure to keep digital records will result in penalties and interest charges.

Initially, the use of spreadsheets for digital record keeping was not approved. However, according to the latest announcement, spreadsheets can be used if they’re integrated with an accounting app to allow digital updates to HMRC.

Quarterly data:

The onset of MTD not only means the end of paper accounting, but it also marks the end of annual returns filing in the UK. Under MTD, you’ll no longer have to file an annual return at the end of the year. Instead, you’ll update HMRC every 3 months. If you’re used to filing annual returns on paper, the new system might require you to spend more time on your bookkeeping.

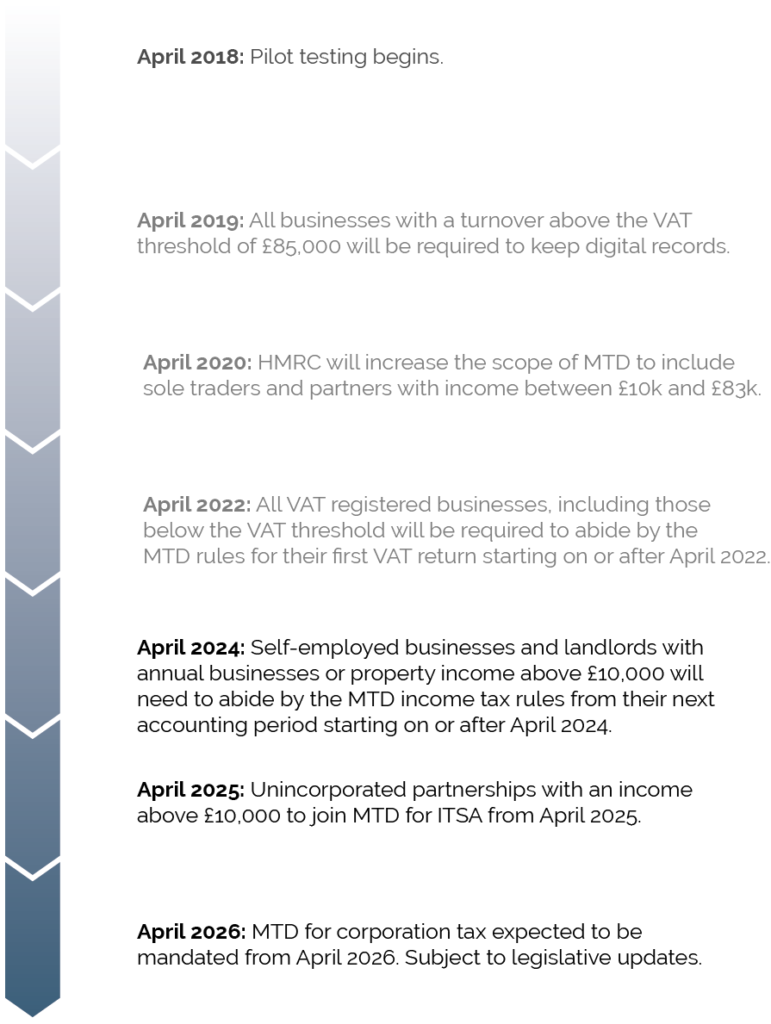

Making Tax Digital (MTD) Implementation

HMRC has published a timeline for implementation:

Benefits of Making Tax Digital (MTD)

One of the main advantages of Making Tax Digital is that it removes the errors and confusion that come along with paper tax filing. But there are more benefits to MTD than meets the eye.

Stress-free Making Tax Digital filing

MTD requires you to submit tax data every quarter. This means you don’t have a mountain of work once a year. In turn reducing the risk and impact of any errors.

Tax in real-time

Having a continuous real-time view of your tax liabilities as they change means you won’t have to wait until the end of the year to find out how much you owe. Helping you manage any payments that are required.

Paperless taxes

Online filing is now mandated so you’ll need to use software to maintain your accounts and regularly update HMRC. Accounting software can detect mistakes as they happen, instead of having to go through every single receipt at the end of the year.

Tax information from any device

With a digital tax process, all of your information is available in one system, making it easy to view and access your tax information anywhere, anytime you need it. You can log in to your account through a smartphone, laptop, or tablet to view and edit the data.

What are some of the challenges with the new system?

While MTD comes with a host of benefits, there are some issues to keep in mind.

Privacy

Yes, with more online transactions and bank data being visible to HMRC, there is potentially an increased lack of privacy that comes with MTD. However, working online adds an extra layer of security to your data and offers fraud protection. This also sets controls in place whereby you can prevent unauthorised access to your bank accounts. The same software also provides an electronic audit trail of transactions that have been carried out, making it easy to find out what actions have been performed by whom and when.

Technology

Submitting returns online requires business owners to commit to accounting software. With a multitude of businesses still using paper accounting, the new policy has caused alarm among the not-so-tech-savvy community of business owners. But accounting software like Zoho Books isn’t difficult to learn and makes online tax filing manageable, even for major technophobes.

Deadlines

Though filing returns every quarter helps eliminate errors, it also means more deadlines to meet and more submissions to make. But this also means you are aware of how much tax you owe, avoiding any unpleasant surprises along the way.

The future of accounting is constantly evolving with new technologies, and MTD is speeding up the process. Though it brings about a drastic change in the way the tax system works, the benefits of MTD outweigh the minor inconveniences that may occur along the way.

Why choose Zoho Books for your MTD needs

While MTD requires businesses to adapt to new methods and technologies. A robust accounting tool like Zoho Books, with its easy-to-use interface, can make this transition effortless. Maintain your financial records digitally, file VAT returns directly to HMRC, reconcile your bank statements, oversee projects, eliminate compliance worries, and more. With Zoho Books at hand, your growing business can get all the accounting capabilities it needs.

Goldstar are not just an Advanced Zoho Partner, we are a Zoho Valued Consulting Partner for Zoho Books. As such we have a dedicated Accounting specialist, Vicki, who can help with any aspect of accounting. Vicki is one of the first authorised experts in the UK and will be able to help make your MTD transition as seamless as possible.