Zoho Books VAT Return UK Edition: Enhanced Drill-Down & Background Export

Earlier, we shared the exciting news that Zoho Books is Now Ready for MTD for Income Tax in the UK. Today, we’re happy to build on that momentum with another important milestone:

Zoho Books unveils a power-packed VAT drill down for the UK edition

This is a major step forward for UK Zoho Books users. The enhanced VAT return drill down will help you convert a mere compliance task into a powerful, insightful experience!.

What’s New?

Turn VAT filing from a checkbox into a source of insight. The UK Edition of Zoho Books now offers a deeper, faster VAT Return drill-down with smarter grouping, new on-screen parameters, quick navigation, and Export All Boxes handled in the background with the file delivered to your email.

| Category | Details |

|---|---|

| Why it matters | VAT reviews often stall on missing context and slow exports. The new drill-down gives instant clarity on where figures come from, speeds reconciliation, and reduces time spent chasing documents—so you and your clients can trust the numbers. |

| How to use it | Open Reports → VAT Return (UK) and click any box to drill down. Use the new parameters to identify source transactions, review smart grouping by Tax Rate and Type of Tax (Reverse Charge, Domestic Reverse Charge, Sales, Purchase), and sort by Date or Transaction No. For large runs, choose Export All Boxes—the export is scheduled in the background and the file is emailed to you with a success confirmation. |

| Our opinion | A high-impact compliance upgrade: faster reviews, fewer back-and-forths, and clearer audit trails. The combination of grouping + sorting + background exports meaningfully shortens month/quarter-end. |

| What to do next | 1) Run your latest VAT Return and drill into outliers using the new parameters. 2) Use grouping to validate Reverse Charge and Domestic Reverse Charge treatments. 3) Trigger Export All Boxes for your working-paper pack and share the emailed file with your client or accountant. 4) Document a short SOP so your team follows the same review steps each period. |

What’s new (at a glance)

- Instant insights with additional parameters on the transaction view

- Smart grouping by Tax Rate and Type of Tax (Reverse Charge, Domestic Reverse Charge, Sales, Purchase)

- Pinpoint navigation with sort by Date and Transaction No.

- Export All Boxes runs in the background, emailed on completion

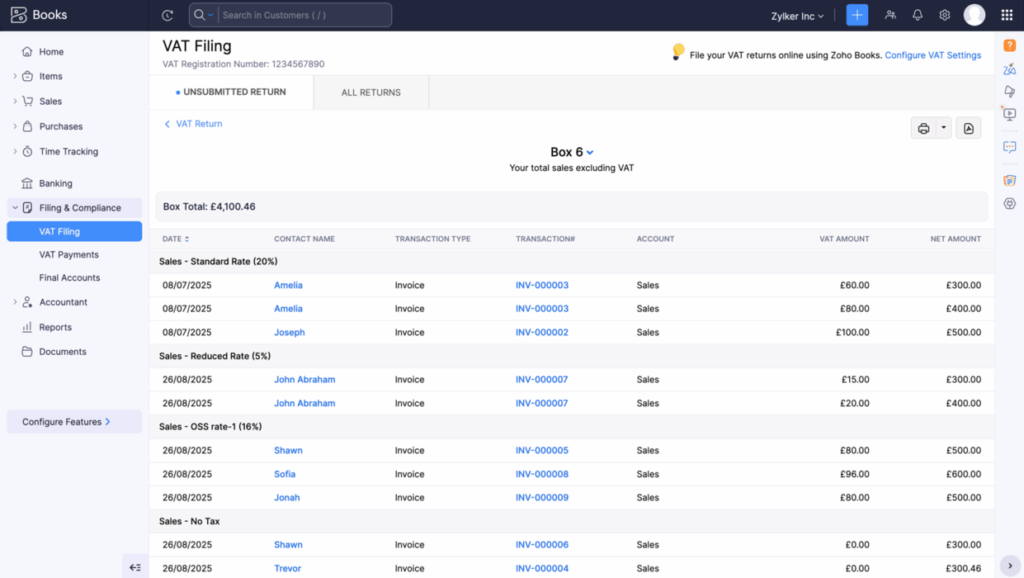

VAT Return Drill-Down: Instant Insights with New Parameters (UK Edition)

The VAT Return drill-down now shows additional parameters on each transaction, so you can see where every figure comes from at a glance. This speeds up reconciliation, reduces back-and-forth, and gives you and your clients greater confidence in the numbers.

| Category | Details |

|---|---|

| Why it matters | Faster root-cause on variances means quicker period close and fewer review cycles. Clear source context cuts time spent chasing documents and lowers the risk of posting corrections late. |

| How to use it | Go to Reports → VAT Return (UK) → click any Box to drill down. In the transaction view, use the new parameters (e.g., tax rate, tax treatment, source document, contact, account) to pinpoint the origin of each amount. Combine with Sort by Date/Transaction No. for faster navigation. |

| Our opinion | A high-impact clarity upgrade: surfacing the right fields in the drill-down turns a compliance checklist into a real diagnostic tool for accountants and clients alike. |

| What to do next | 1) Re-run your current VAT Return and open the largest box variance. 2) Use the new parameters to trace outliers in seconds. 3) Capture a workpaper by running Export All Boxes (background) and filing the emailed pack with your month/quarter close. |

✅ Quick Takeaway

New drill-down parameters show the source behind each VAT figure instantly — faster reconciliation, fewer queries, cleaner close.

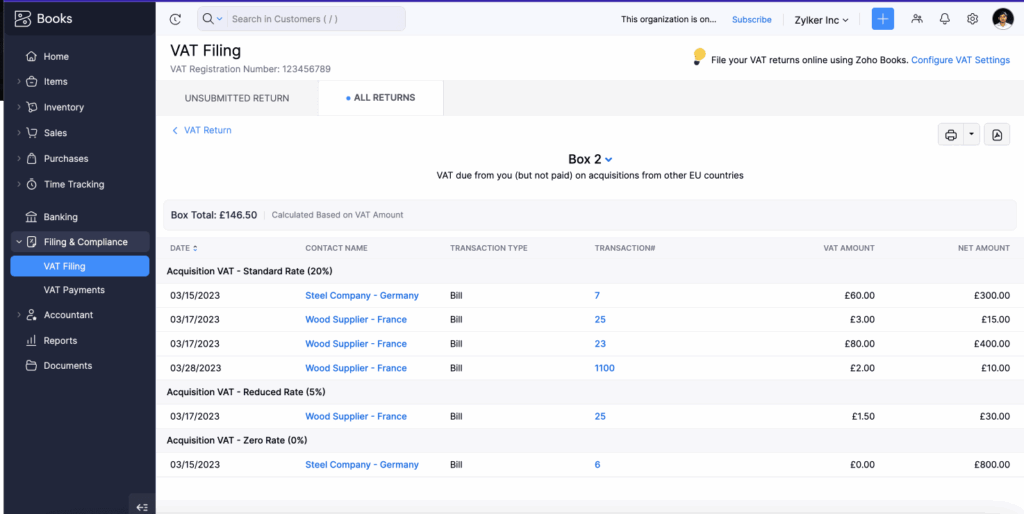

VAT Return Drill-Down: Smart Grouping for Context (UK Edition)

The drill-down view now groups transactions by Tax Rate and Type of Tax — including Reverse Charge, Domestic Reverse Charge, Sales, and Purchase. This structure makes complex VAT data instantly readable and shows exactly how each segment contributes to your VAT liability.

| Category | Details |

|---|---|

| Why it matters | Grouping turns a long transaction list into a clear composition view. You’ll spot misclassified entries, verify reverse-charge treatments, and reconcile box totals faster — reducing review cycles and late adjustments. |

| How to use it | Go to Reports → VAT Return (UK) → click a Box to drill down. Use the new Group by: Tax Rate and Group by: Type of Tax toggles to segment results. Expand/collapse groups to review contributors, then combine with Sort by Date/Transaction No. for quick document lookup. |

| Our opinion | This is the missing lens for VAT: a structured, accountant-friendly view that surfaces rate/treatment issues immediately and supports cleaner workpapers. |

| What to do next | 1) Run your latest return and group by Type of Tax to validate Reverse Charge and Domestic Reverse Charge postings. 2) Switch to group by Tax Rate to confirm rates applied (e.g., 0%, 5%, 20%). 3) Note anomalies and fix mappings before filing. Pair with Export All Boxes (background) to archive your grouped evidence. |

✅ Quick Takeaway

Grouped by Tax Rate & Type of Tax = instant clarity on VAT composition — faster variance checks, fewer errors, and smoother filings.

VAT Return Drill-Down: Pinpoint Accuracy with Faster Navigation (UK Edition)

Need a specific document fast? You can now sort drill-down results by Date and by Transaction Number, so you jump straight to the exact invoice, bill, or journal in seconds.

| Category | Details |

|---|---|

| Why it matters | When deadlines loom, scrolling through long lists costs time and invites mistakes. Precise sorting delivers faster variance checks, cleaner audit trails, and quicker period close. |

| How to use it | Go to Reports → VAT Return (UK), click any Box to drill down, then use the Sort control to order results by Date or Transaction No. Combine with the new parameters and grouping options for laser-focused reviews. |

| Our opinion | A small UX tweak with big impact. Sorting by the two fields accountants use most turns drill-down into a find-it-now tool instead of a fishing expedition. |

| What to do next | 1) Re-run your return and sort the busiest box by Transaction No. to trace a suspect posting. 2) Switch to Date to review end-of-period entries. 3) Capture evidence via Export All Boxes (background) to complete your workpapers. |

✅ Quick Takeaway

Sort by Date or Transaction Number to find the right transaction instantly — fewer clicks, faster reconciliations, smoother filings.

Simplify your switch to Zoho Books

Effortless Exports with Background Scheduling

Dealing with large datasets shouldn’t mean waiting. We’ve introduced a feature designed for efficiency:

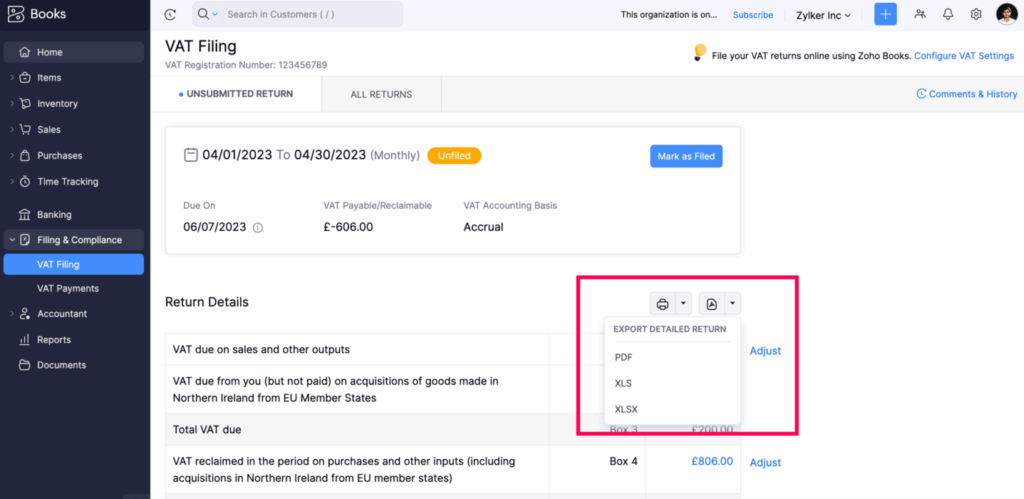

VAT Return Drill-Down: Export All Boxes — Simplified (UK Edition)

No more waiting on large exports. When you choose Export All Boxes, Zoho Books now schedules the export in the background and emails the file when it’s ready—so you can keep reviewing while the pack is prepared.

| Category | Details |

|---|---|

| Why it matters | Big VAT datasets used to stall your workflow. Background exporting avoids page timeouts, saves minutes per review, and keeps your team moving during close. |

| How to use it | Go to Reports → VAT Return (UK) → click Export All Boxes. The export runs in the background; you’ll receive a success email with the file attached or linked as soon as it’s complete. |

| Our opinion | A deceptively simple upgrade that removes friction right where deadlines bite. It turns exporting into a set-and-forget step in your VAT workpapers process. |

| What to do next | Add Export All Boxes to your VAT review SOP. Kick it off early, continue drill-down checks (parameters, grouping, sorting), then file the emailed pack with your working papers. Consider a shared mailbox for audit continuity. |

✅ Quick Takeaway

Start Export All Boxes and keep working—your VAT pack is prepared in the background and delivered to your inbox when ready.

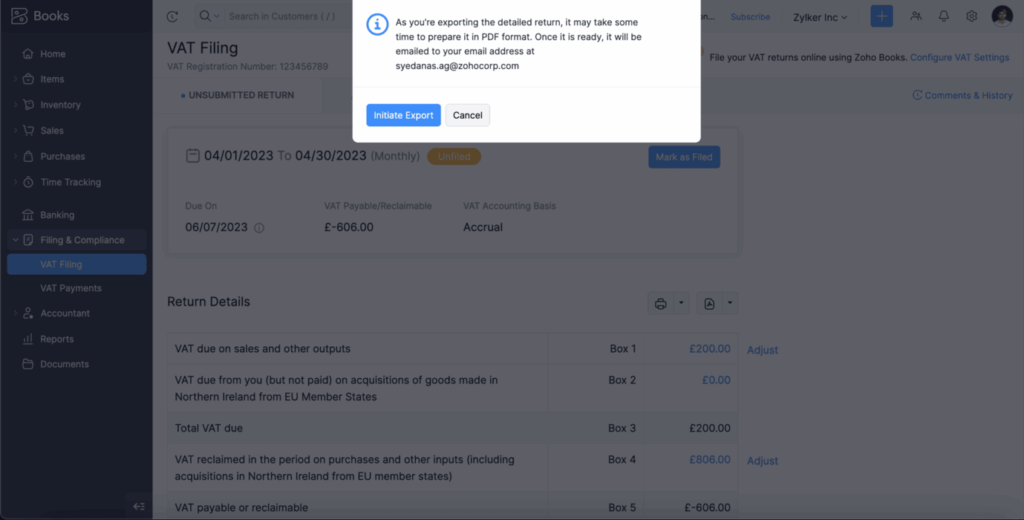

VAT Return Drill-Down: Direct Delivery of Exports (UK Edition)

When your Export All Boxes finishes, the export file is delivered directly to your email with a success confirmation — no manual downloads or page babysitting required. Large VAT datasets are handled efficiently and securely.

| Category | Details |

|---|---|

| Why it matters | Email delivery prevents timeouts, avoids broken downloads, and creates a clear audit trail (timestamp + sender). Your working papers arrive reliably, even for large returns. |

| How to use it | From Reports → VAT Return (UK), choose Export All Boxes. The export runs in the background and, on completion, you’ll receive a confirmation email containing the export file (or a secure link). |

| Our opinion | A small change with big ops impact: background processing plus email delivery turns exporting into a dependable, audit-friendly step in your VAT close. |

| What to do next | Add a shared finance mailbox for export notifications, file the email + attachment to your period folder, and update your VAT SOP to capture the email as part of your evidence trail. Consider mail rules to tag/route “VAT export success” automatically. |

✅ Quick Takeaway

Your Export All Boxes pack is emailed to you on completion — reliable delivery, better audit evidence, zero waiting.

Zoho Books VAT Return (UK): Live Now & What’s Next

The enhanced VAT Return drill-down and background exports are live now in Zoho Books (UK). You can explore deeper parameters, smart grouping, faster sorting, and “Export All Boxes” with email delivery today.

The UK VAT Return experience is now faster, clearer, and more auditable — with targeted filtering and a richer return pack on the way.

Coming soon

- Filter by Tax Rate in the drill-down for even faster targeting of variances.

- Detailed return pack including the VAT return page plus your business VAT information for a single, shareable evidence file.

Next Steps

- Need some help with your Zoho Books VAT return? Contact us

- Have questions? Book a meeting with our expert Vicki and find out more.

Let’s talk about how Zoho Books can work for you!