Zoho Books update October 2023

Welcome to another month of innovation and efficiency with Zoho Books! We’re thrilled to introduce a suite of powerful updates designed to elevate your accounting experience with Zoho Books update October 2023.

This month, Zoho have focused on enhancing your control and precision in managing finances. From customisable tax deductions to streamlined inventory operations, our latest features empower you to navigate your financial landscape with confidence.

TDS Amount Override in Zoho Books!

Exciting times for precision in accounting! Zoho have introduced a groundbreaking feature: TDS Amount Override. This tool gives you the power to configure and edit the system-generated TDS amount in transactions, ensuring your tax deduction at source aligns perfectly with your financial requirements.

Key Benefits of TDS Amount Override

Tailored Tax Deductions

Customize TDS amounts effortlessly. With the ability to edit system-generated TDS figures, you can ensure precise deductions, aligning your transactions with the exact tax obligations of your organisation.

Compliance Confidence

Stay compliant effortlessly. By fine-tuning your TDS amounts, you can confidently adhere to tax regulations, preventing any discrepancies and ensuring a seamless, compliant financial operation.

Streamlined Transactions

Simplify your financial processes. The TDS Amount Override feature streamlines your transactions by allowing you to adjust TDS figures as per specific transaction requirements, enhancing the accuracy and integrity of your financial data.

Flexible Financial Planning

Plan your finances effectively. By having control over TDS amounts, you can strategise your financial decisions better, ensuring your organisation’s budget allocation and financial planning are precise and efficient.

Take command of your tax deductions. Explore the TDS Amount Override feature in Zoho Books this October, and experience a new level of control and accuracy in your financial operations.

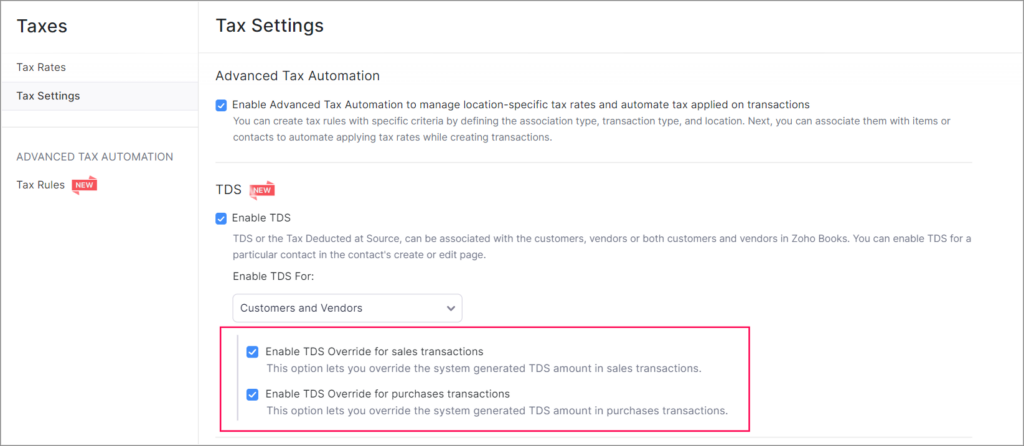

To configure TDS override, go to Settings > Taxes > Tax Settings. Select the required option under TDS.

Introducing Reject and Edit Options for Transfer Orders and Inventory Adjustments

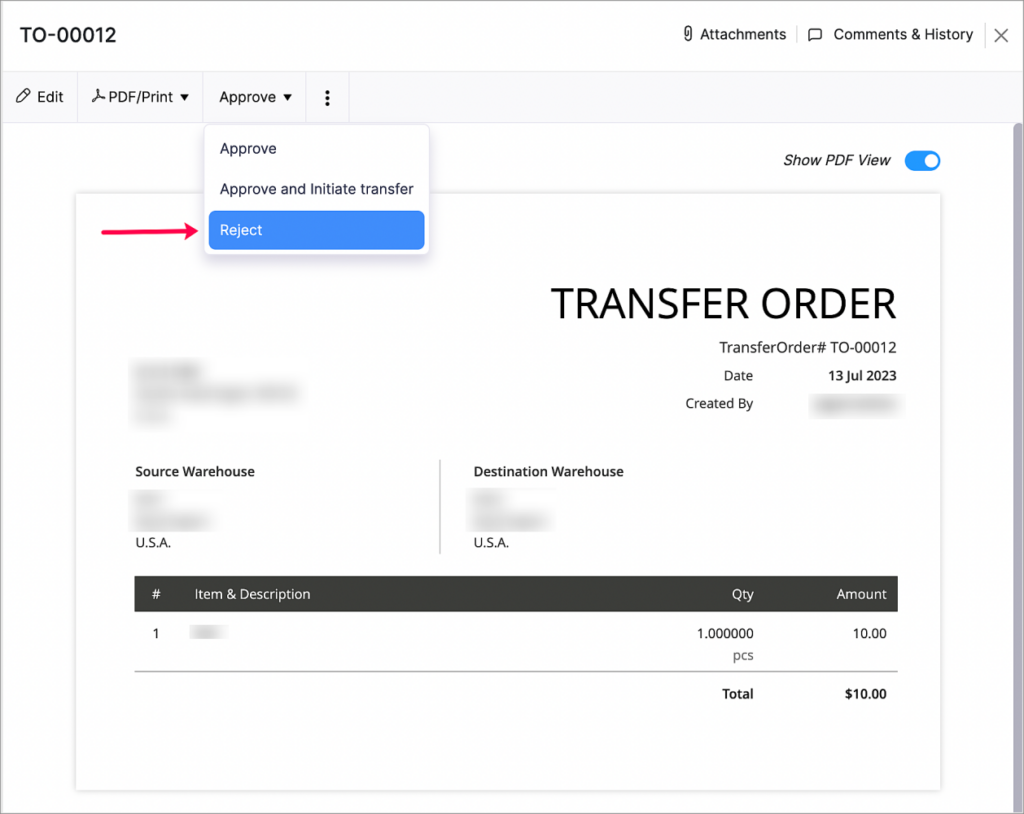

Exciting news for seamless operations! Zoho have enhanced your control over inventory management with the ability to reject transfer orders and inventory adjustments submitted for approval. This feature empowers authorised users to maintain precise control over their inventory records, ensuring accurate stock levels and streamlined operations.

Key Benefits of Reject and Edit options

Enhanced Accuracy

Maintain precise inventory records. With the ability to reject and edit transfer orders and inventory adjustments, you ensure that your stock levels accurately reflect your business operations, preventing discrepancies and optimising your inventory management.

Streamlined Approvals

Facilitate smoother approval processes. Authorised users can reject transactions that do not meet the required criteria, enabling a streamlined approval workflow. Additionally, rejected transactions can be resubmitted, ensuring continuity in your inventory operations.

Dynamic Adjustments

Make real-time adjustments effortlessly. Edit the Quantity Adjusted in pending or approved inventory adjustments, allowing you to adapt to changing demands without delays. This dynamic editing feature ensures your inventory data is always up-to-date and responsive to your business needs.

Zoho Inventory Integration

For organisations with Zoho Inventory Add-on enabled, take full advantage of this feature. Seamlessly manage transfer orders, ensuring your stock moves efficiently across locations, and optimise your inventory management strategy for maximum efficiency.

Embrace the power of precise inventory control. With the Reject and Edit options, you can maintain accurate stock records, facilitate seamless approvals, and adapt to changing demands with ease.

Prevent Duplicate Payments

We understand the challenges posed by payment processing times, especially with methods like ACH or direct debit that can take a few days. That’s why we’re excited to introduce the Prevent Duplicate Payments preference, a powerful tool to enhance your payment security. With this feature enabled, you can rest easy knowing that duplicate payments won’t be an issue anymore.

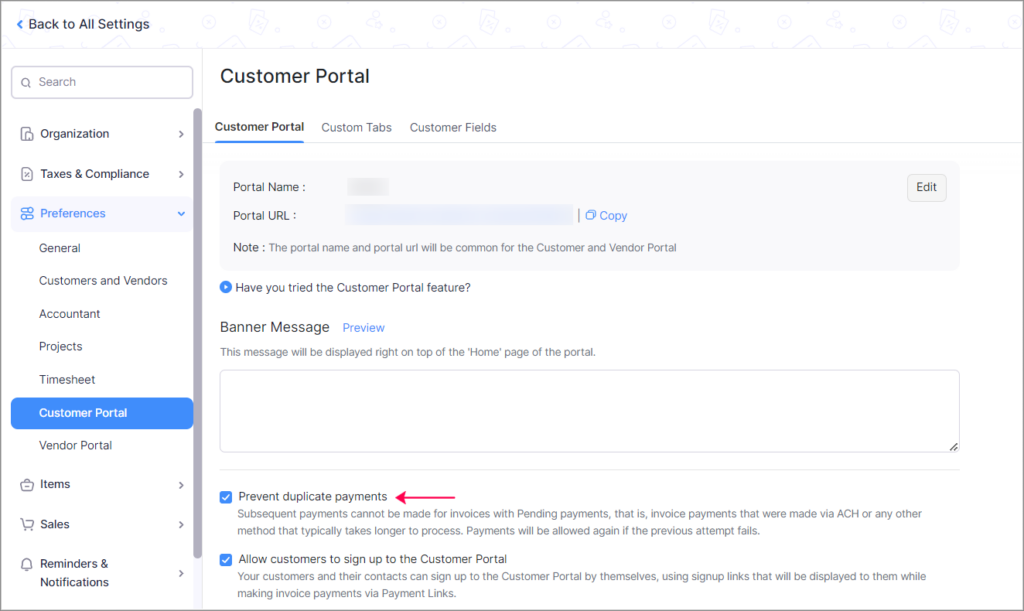

To enable this, go to Settings > Customer Portal > General. Mark the Prevent duplicate payments checkbox. Click Save.

Key Benefits in preventing Duplicate Payments:

Enhanced Customer Experience

Eliminate confusion and frustration for your customers. By preventing duplicate payments, you ensure that your clients won’t accidentally initiate multiple transactions for the same invoice, providing them with a seamless payment experience.

Saves Time and Resources

Say goodbye to the hassle of refunding duplicates. With this feature, you won’t have to deal with the administrative burden of managing and returning excess payments. It streamlines your workflow and saves you valuable time and resources.

Comprehensive Application

Rest assured that this preference covers all payment avenues. Whether it’s through transaction PDFs, email notifications, payment links, or the Customer Portal, the Prevent Duplicate Payments feature guarantees a consistent and secure payment experience across the board.

Error Prevention

Minimise the risk of payment errors. By restricting subsequent payments until the initial attempt concludes, you reduce the possibility of erroneous transactions, ensuring accurate accounting and financial records.

Experience peace of mind in your payment processes. Enable the Prevent Duplicate Payments preference and provide your customers with a smooth, error-free payment journey while saving your business time and effort.

As always, your feedback drives our commitment to excellence. As a result of feedback from Zoho users at the recent Zoholics 2023 we are adding updates for Zoho Invoice from this month. Please contact us if you need any help with the new features listed here – or any aspect of you Zoho deployment.

Plus don’t forget to check out our YouTube channel where we have a selection of quick Zoho tutorials to help you get more from your solutions – here’s a sample of the useful content available there…

Until we see you next month let’s make Zoho Books update October 2023 your most productive one yet!